Case Studies

The supplier's rep slowly walks through every aisle of the supermarket. For each item she notes how many need restocked. When done in the store, with one click

the numbers disappear into the cloud

and she heads to the next store. From the cloud it downloads to the warehouse(s). There it separates into locations within warehouses. Picking tickets queue in order by

delivery truck schedules. Packing creates lists for shipping, reorder quantities for suppliers, backorder quantities for the store and shipped quantities for accounting.

Daily accounting uploads thousands of invoices separating by store, department and ship date. It downloads logs showing payment deposits made through ACH. Each log details invoices paid with adjustments for returns, coupons and manufacturers' specials. Customer adjustments are passed to accounts payable as vendor credits. Managers constantly monitor pricing, backorders and returns by rep and store to maximize sales.

Daily accounting uploads thousands of invoices separating by store, department and ship date. It downloads logs showing payment deposits made through ACH. Each log details invoices paid with adjustments for returns, coupons and manufacturers' specials. Customer adjustments are passed to accounts payable as vendor credits. Managers constantly monitor pricing, backorders and returns by rep and store to maximize sales.

A parade of trucks full of coal pass over the scales. Their weight and truck number are captured similar to EZ Pass. Delivery tickets recording this data route through the

cloud to accounting. Periodically laboratories analyze samples of coal for their btu/lb heating value and their moisture, sulfur, ash and volatiles. Clerical staff record

the test results against each delivery.

Purchasing agreements typically have a base price per ton with adjustments for test values. Sometimes coal is 'cleaned' which improves its quality but lowers its tonnage.

Each month reports show all parties the deliveries with the base price and all the price adjustments and any shipping fees per ton. Trucking companies get the shipping fees possibly with overwweight penalties for road damage.

Purchasing agreements typically have a base price per ton with adjustments for test values. Sometimes coal is 'cleaned' which improves its quality but lowers its tonnage.

Each month reports show all parties the deliveries with the base price and all the price adjustments and any shipping fees per ton. Trucking companies get the shipping fees possibly with overwweight penalties for road damage.

The utility worker steps outside the borough office. He holds a radio device up for a couple minutes. It 'reads' every meter in the borough. Back inside

he plugs it into its cradle and uploads all the readings. By the end of the day the month's electric bills are printed and sent to all the residents.

It's been a Pennsylvania municipality for a long time. Older residents often pay more than they owe just to feel safe. Younger ones, incredibly, often pay a day or two after they receive their termination notice and fee. The Accounts Receivable program just needs the account and payment amount to disburse the monies correctly. The accounting system understands the state's fund accounting methodology.

It's been a Pennsylvania municipality for a long time. Older residents often pay more than they owe just to feel safe. Younger ones, incredibly, often pay a day or two after they receive their termination notice and fee. The Accounts Receivable program just needs the account and payment amount to disburse the monies correctly. The accounting system understands the state's fund accounting methodology.

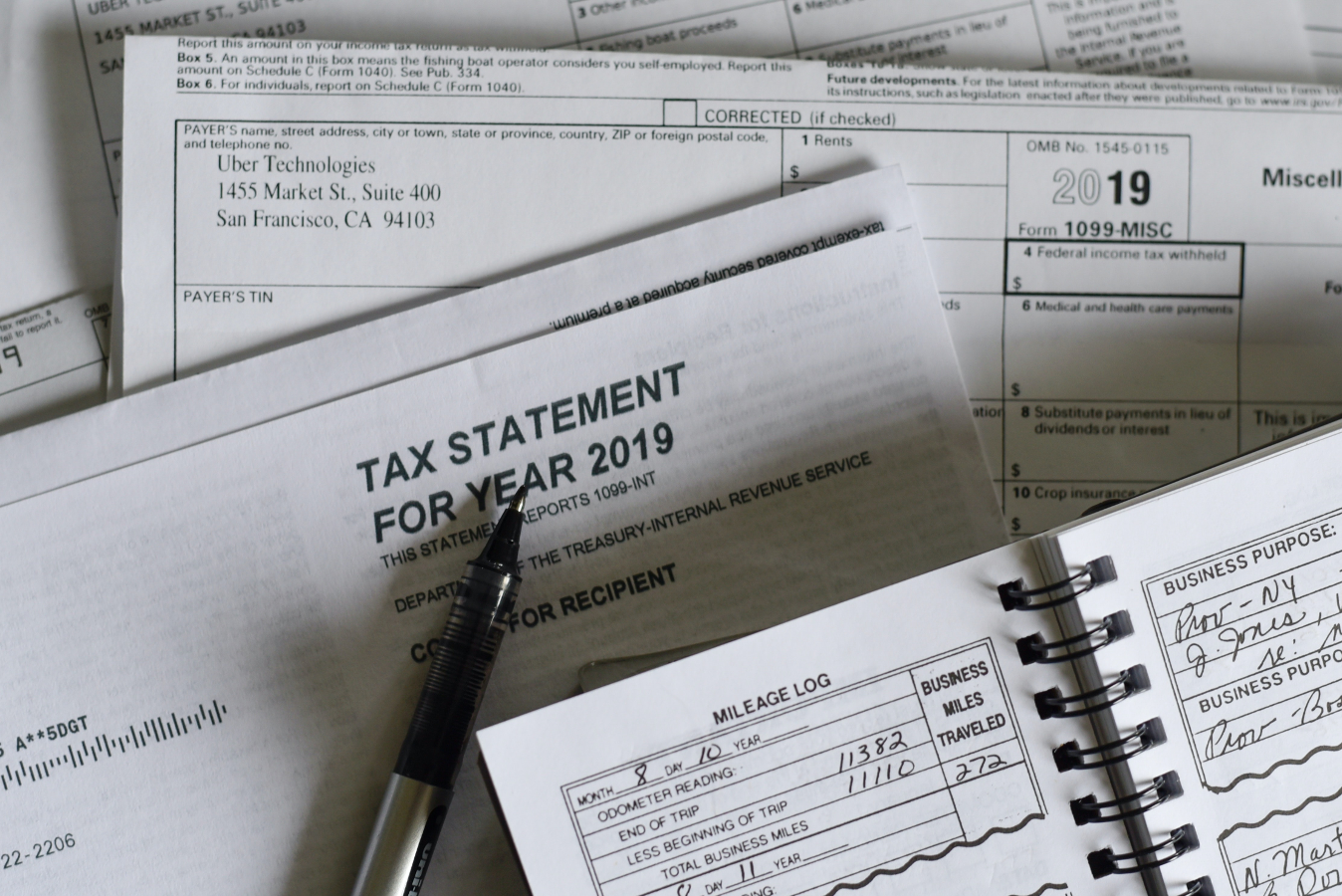

In January the IRS implemented a new W-4. Their site says it reduces complexity and increases the transparency and accuracy of the

withholding system. On the previous form your options were to enter your number of dependents and any additional withholding amount

you desired. The new form has five steps to optionally complete and for Step 2 has an optional online app of multiple steps you can

use 'for maximum accuracy and privacy'.

Many employees were filling in just their personal information and signing the complex new form. Unfortunately none of these options show what the final withholding amount would be. Fortunately instructions to employers includes a worksheet that does. We created a free W-4 calculator to help employees see and control their withholding amount.

Many employees were filling in just their personal information and signing the complex new form. Unfortunately none of these options show what the final withholding amount would be. Fortunately instructions to employers includes a worksheet that does. We created a free W-4 calculator to help employees see and control their withholding amount.